Germany, a Major European Wheat Producer

Reading time: 9 minutes

![]() Free Article

Free Article

France & Germany, the Largest Players in Wheat Production and Export in Europe

In 2022, France and Germany produced half of the EU’s Wheat. French Wheat production reached 36.08 Mmt in 2022, compared to 149.5 Mmt total volume for the EU. Germany ranked second, with 2021 Mmt harvested. Moreover, France and Germany exported significant volumes compared to the rest of the EU even though they only ship about 15% and 11% of their respective productions. On the other hand:

- Romania exported 6.54 million tons between Jan and Sep 2022, out of a total Wheat production of 11 Mmt.

- Bulgaria exported more than half of its output to European and non-European countries.

- Spain – which ranks as the fourth EU largest producer in 2022– and the rest of the EU countries export a negligible value of Wheat and rely more on the EU intratrade.

Figure 1: Europe Wheat Production in MY2021/2022 and Exports Between Jan & Sep 2022

Track European Countries Wheat Production and Exports Since 2017

Free & Unlimited Access In Time

Read also: South Korea Turns to Bulgarian Wheat

Germany’s Positioning in Wheat Market

Overall, Germany’s Wheat production decreased by 1.6 Mmt between 2019 & 2022. Although, Germany’s exports increased substantially in 2019 & 2020 during the Spring Wheat harvest seasons to peak in 2021 during the Winter Wheat harvest season. Indeed, Wheat production & exports surged in 2020, reaching over 23Mmt & 4.77 Mmt, respectively. However, production and exports declined progressively in 2021 and 2022. In 2022, Germany increased its harvested Wheat area to compensate, and USDA estimates that production will increase by 0.54 Mmt in the MY 2022/2023.

Figure 2: Germany’s Monthly Wheat Export Volumes Between Jan 2019 &Sep 2022

Track Germany and Other EU Countries Monthly Wheat Exports Since 2017

Free & Unlimited Access In Time

Iran, North and West Africa as the Major Destinations for German Wheat

So far, Iran was the primary destination for German Wheat exports between Jan & Sep 2022. Iran produces an average of 12.99 Mmt of Wheat and imports 2.81 Mmt yearly. However, import volumes increased drastically to 6.5 Mmt in MY 2021/2022 due to severe droughts, thus increasing Wheat imports from Germany, to reach 1.042 Mmt between Jan & Sep 2022. Germany’s second most important pipeline for Wheat are North and West Africa. Between Jan & Sep 2022, Nigeria, Guinea and Algeria recorded 513 kmt of combined Wheat imports.

Figure 3: The Six Top Destinations of German Wheat Between Jan & Sep 2022

Track Monthly Germany Wheat exports to Up to 18 destinations

Free & Unlimited Access In Time

How Do Sanctions Affect Germany’s Wheat Prices?

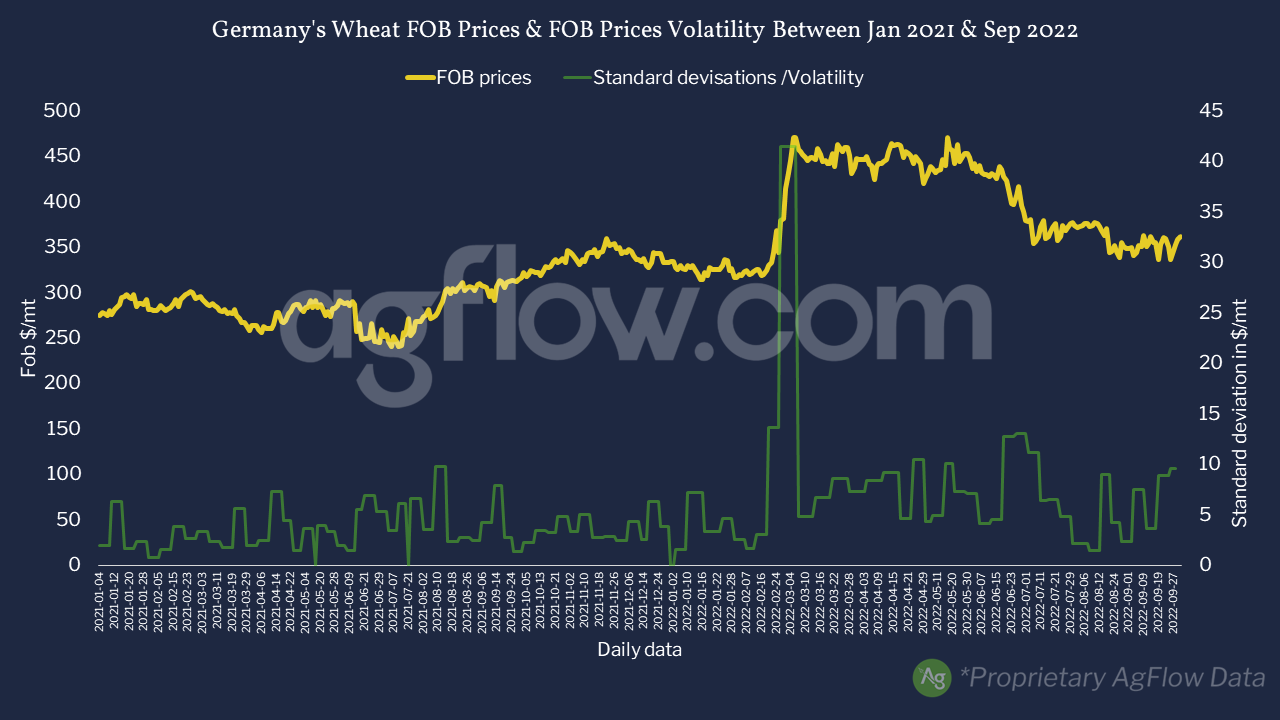

With the Russia-Ukraine War starting in Mar 2022, German Wheat FOB cash prices jumped to a peak of 470 $/mt in Mar and 471.5 $/mt in May. However, with Ukraine and Russia agreeing to allow grain exports to resume through the Black Sea in Jul, Germany’s Wheat FOB values declined. Historically, Germany Wheat FOB prices were more volatile in Q2 and Q3. However, by the end of Feb 2022, the volatility was extremely high, which coincided with the start of the war. In 2021, Germany’s Wheat FOB price volatility was 3.7 $/mt on average; and it soared to 7.6$/mt in 2022. The prices and their volatility will depend on the evolution of the conflict in Ukraine for the 22/23 crops, due to Europe’s reliance on Russian fertilisers and gas which impacts production and availability across all products, including Potash, Nitrogen, and Phosphorus.

Figure 4: Germany’s Wheat FOB Prices & FOB Prices Volatility Between Jan 2021 & Sep 2022

Access 3.7k+ Monthly Wheat FOB Prices From Up to 24 Origins

Free & Unlimited Access In Time

In a Nutshell

Germany is a major European Wheat producer and exporter. So far in 2022, Germany exported 11% of its production, mainly to Iran, North Africa, and West Africa.

However, due to the war in Ukraine and low yields, Germany’s Wheat exports decreased YoY and Wheat prices rose to $471/mt. Yet, USDA estimates the new crop to increase by 0.54 Mmt in the MY 2022/2023 YoY, which could help decrease prices.

Despite the ongoing war, Russia kept supplying the world with Wheat. According to USDA estimates, Canada has also increased production this year, and exports will rise in MY 2022/2023. However, Europe supplies of Russian gas and fertiliser interruptions could lead to lower production next year. In addition, flooding in Pakistan has affected the country’s yields and could significantly impact the global S&D balance for Wheat and Rice, which could lead to higher global prices, as well as demand adapting its pipeline to accommodate for the situation. Moreover, US Wheat production was low this year due to droughts and extreme heat, and exports declined consequently. Meanwhile, China has significantly increased its Wheat imports this year due to increased domestic consumption in addition to poor production.

Finally, a tighter Wheat supply and high prices raise the question of food security for vulnerable populations in the coming years, mainly in major importing countries in MENA, for which price changes are felt directly by the consumer. For example, Egypt imports 27% more Wheat than it produces yearly, higher prices will result in lowering imports, In consequence, a tight supply to the market.